Houses As An Investment

I've owned a home for over 7 years now, and I've come to realize a hard truth. Your home, and mine, is not an investment. By investment I mean money that is put away with the purpose of earning profitable returns. (Thanks wiki!)

On the surface it appears that owning a home does net you a profit. You buy it for a certain price, and then years later you sell it for more. Unfortunately, that simplistic view leaves out two important factors.

1) Maintenance costs. How much money did you spend to put a new roof on your house? How much was that fence? The new water heater? Replacing the carpet? The blinds? How much of your 'profit' was bled away after years of home ownership?

Still think you're ahead? Look behind door number 2:

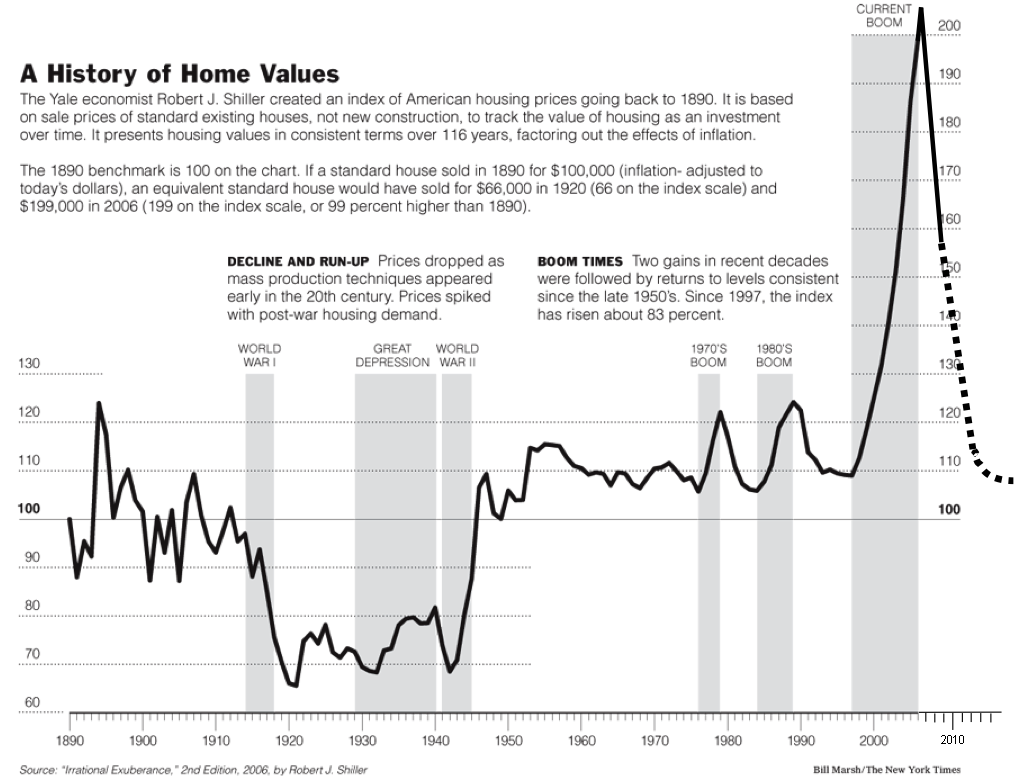

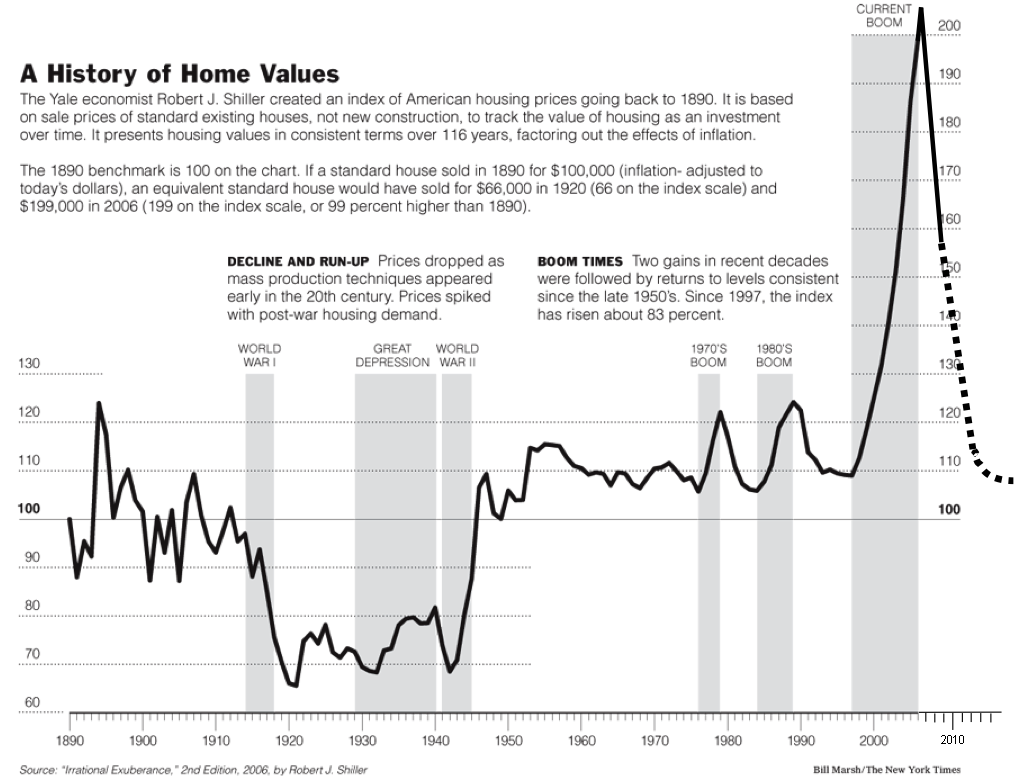

2) Inflation creates the illusion of wealth. A Yale economist laid out this graph of home prices over the last 100 years. He kindly removed the effects of inflation so we can more clearly see the value of our homes.

Outside of the latest housing boom and current bust, home prices have stayed just about the same. If you bought a home in the 60's, you can expect it to be worth just about exactly the same price.

Your home is inflation protection, and little else. Or course, you get to live in it, so there are some perks.

On the surface it appears that owning a home does net you a profit. You buy it for a certain price, and then years later you sell it for more. Unfortunately, that simplistic view leaves out two important factors.

1) Maintenance costs. How much money did you spend to put a new roof on your house? How much was that fence? The new water heater? Replacing the carpet? The blinds? How much of your 'profit' was bled away after years of home ownership?

Still think you're ahead? Look behind door number 2:

2) Inflation creates the illusion of wealth. A Yale economist laid out this graph of home prices over the last 100 years. He kindly removed the effects of inflation so we can more clearly see the value of our homes.

Outside of the latest housing boom and current bust, home prices have stayed just about the same. If you bought a home in the 60's, you can expect it to be worth just about exactly the same price.

Your home is inflation protection, and little else. Or course, you get to live in it, so there are some perks.

6 Comments:

Two things, first is what does he consider "standard existing homes" and secondly, it looks like the graph is showing that homes have actually gone up about 10% in value throughout the majority of the time. This is with the exception of economic bursts and booms. So, excluding maintenance costs, it looks to still be an average investment.

It's difficult to say what a 'standard existing home' is, but according to the National Association of Home Builders the average square footage has almost doubled in the last 50 years. Presumably a standard existing home in this graph has the same square footage throughout the graph, other wise things are much worse than the graph portrays.

An increase of 10% over 100 years, even adjusted for inflation, is a terrible investment. The stock market, adjusted for inflation over the same period still yields a 10 times increase.

I thought the purpose of purchasing a home was to own it. Thus the only fees you have are maintenance. Unlike renting where you have the monthly payments and absolutely nothing to show in the end.

Ok, let's play with some numbers. In Lawrence a nice rental with 2 bedrooms is going to cost you $700 a month.

- Fertilizing, mowing, and watering a lawn costs $500 a year.

- Fence repairs cost $1000 every 10 years, or $100 a year.

- A roof costs about $15,000 every 15 years, or $1000 a year.

- Carpet replacement we'll say $3,000 every 5 years, or $600 a year.

- Fixture and appliance replacement/repair is probably $1000 every 5 years, or $200 a year.

- Water damage to windows/frame/paint is maybe $5,000 every 10 years, or $500 a year.

- Insurance is something like $800 a year and renters is like $200 a year, so we'll go with $600.

- Property taxes are about $2000 a year.

Total : $5,500 a year in maintenance, or about $450 a month.

So if you buy a house with a mortgage of $700. You're actually paying $1150. You get to keep a small amount of that, but it will still takes 25 years before your interest payments drops to $250, so that your out of pocket is $700. That's 25 years of about $800 more a month that you piss away owning a home. $240,000 that could be earning 4%, or $800 a month. Huh, suddenly your rental cost is free.

Of course, I've ignored inflation over those 25 years which would affect your rental cost. I've also ignored the fact that a home is much much nicer than some 2 bedroom rental. I've also ignored the accumulated interest on that 240,000 over the 25 years. I skipped cost for painting inside the house, pest control, rot, foundation leaks etc.

Basically, my whole point is that owning a home is not a clear cut financial win.

There are many, many factors. If you're looking at it through the lens of 'investment', then you have to consider the leverage involved in owning a house when calculating percentages. The value of the home may increase only 10% over a certain number of years, but if you only put down 10% to start with, then that represents a 100% investment return to you. (modulo various costs as discussed above)

Of course, the real question may not be 'investment' in the classic sense, but one of where you stand in comparison to where you would have been had you chosen to do differently with your money. Given the propensity of most people to spend anything they get their hands on rather than save or invest in anything, owning a house becomes a form of forced savings. And when they sell it, they have infinitely more than they would have had had they spent it on potato chips and beer instead...

Sure, you could look at your 10% gain as a 100% return of your down payment, but then you have to view the rest of your mortgage payments as a total loss.

The forced savings stance is a good argument for the home, but it basically falls into a category outside of a pure financial view.

Once you look at a home's advantages outside the pure financial, it becomes a clear choice. Things like privacy, space for social events, space for children and pets, and other 'nice things' make owning a home worth the financial loss.

I do not regret purchasing a home, but I am waking up to the cost of owning a home.

Post a Comment

<< Home